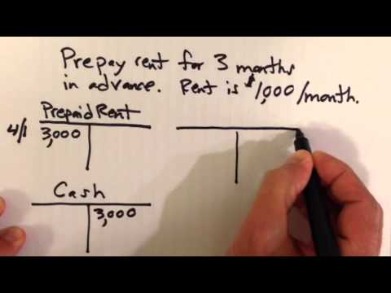

Since your software for accounting is connected to the cloud, they can use their own login to access reports like the general ledger, balance sheet, or cash flow statement whenever they need. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so how to depreciate property you can stay on track for tax time and run your business with confidence. All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track income and expenses. First, you can write and print checks directly from QuickBooks to pay for expenses that require immediate payment. Second, you will be able to enter and track bills and apply the payment of these bills correctly so that the expense is not recorded twice. Additionally, you’ll learn how to write off bad debts, which are recorded as an expense in QuickBooks.

Learn to create meaningful reports and assess your business’s financial health using revenue, expenses, profits, and cash flow. You will be able to manage all of your downloaded banking transactions by the end of this section. Finally, you can use the reconcile tool to ensure the transactions on your bank statement match what has been entered into QuickBooks, resulting in up-to-date financial statements.

Get peace of mind with help from Live experts

- For an extra $25 a month, users gain access to more standard reports, accounts payable management and payment, and time tracking.

- When customers no longer have an active, paid subscription, they will not be eligible to receive benefits.

- QuickBooks Plus is the most popular plan for businesses since it includes features such as inventory tracking, project management and tax support.

- The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops.

Even after initial setup, the software commission income must also let users modify information like company name, address, entity type, fiscal year-end, and other company information. In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users. With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. QuickBooks Simple Start has a decent ability to record and track payments to independent contractors, making it easier to stay compliant with tax regulations.

Can QuickBooks Online do payroll?

Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use. A difference between debtors and creditors notable new feature is Spreadsheet Sync, which helps you generate consolidated reports across multiple entities easily. It is an advanced feature that lets you import and export data between QuickBooks and Microsoft Excel. You can easily generate custom reports in a single spreadsheet, create complex calculations, and use Excel’s built-in tools to work on your data. Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced. Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually.

When to Consider a QuickBooks Online Alternative

You can sign up for a free 30-day trial, which should be long enough to help you decide if this is the best accounting solution for your business. This module will teach you to download and track your credit card purchases in QuickBooks and reconcile them with your credit card statement to ensure that they match. You’ll also learn how to manage credit card sales with either a QuickBooks Payments account integrated with QuickBooks or a third-party credit card processor. You should consider accepting credit card payments as a convenience for your customers and to expedite the collection of outstanding invoices. For an extra $25 a month, users gain access to more standard reports, accounts payable management and payment, and time tracking. This takes into account customer management, revenue recognition, invoice management, and collections.

This hands-on approach helps us strengthen our accounting software expertise and deliver on the Fit Small Business mission of providing the best answers to your small business questions. QuickBooks Online offers four standard plans—Simple Start, Essentials, Plus, and Advanced—with prices ranging from $35 to $235 per month. They vary in the number of users and features included and are built for different purposes. We offer flexible plans and pricing to meet your needs and budget. Whether you just want help tracking receipts or you’re looking to automate complex workflows and support a large team, we have options for you. By the time you complete this section, you will be ready to start using QuickBooks to manage all of your income and expenses.

Know where your money is going

When you add a new vendor, you can designate them as a 1099 contractor. This ensures that their payments are tracked separately for 1099 reporting purposes. QuickBooks Simple Start is a good fit for businesses that are seeking a double-entry accounting system and for those with employees because of its integration with QuickBooks Payroll. Nearly 70% of business owners who have been there, done that, recommend writing a business plan before you start a business.

Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform. The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments. Advanced users receive better customer support through its Priority Circle membership. As a Priority Circle member, you get access to a dedicated customer success manager who can assist you with any questions or issues you have with your software.

If you run your own accounting practice, check out QuickBooks Online Accountant. All data transferred online is protected with 128-bit SSL encryption. When an invoice is past due, follow these five steps to collect outstanding payments so you can get paid sooner. In this episode, Harlem chocolate Factory founder Jessica Spaulding recalls a few of her early money management mishaps, and three big lessons learned.